by Patrick Coleman, Sales Director, IT2 Treasury Solutions Limited

STP – straight-through processing – has in the past been seen as technology that could only be afforded by banks, by other large financial institutions, and by the most complex corporate treasuries. Corporate treasury management systems have now evolved to the extent that they can deliver automated, cost-effective treasury process management, which allow workflows to be automatically managed and monitored. STP implementation is, therefore, now within the reasonable technology budget range for large and most medium-sized corporate treasuries.

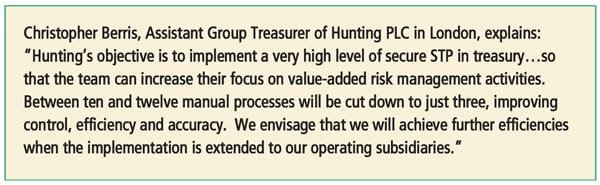

There are numerous definitions of STP that relate to a range of commercial and technical environments. For the purposes of this article, STP is defined as ‘the facility to process a treasury transaction from start to finish with minimal human intervention.’ Such a high level of automation is attractive to all treasurers who struggle with their supporting technology to process the day’s business with minimal errors. Processes which are exclusively or largely manual are prone to encounter control, reliability and accuracy issues, such as the missing of critical payment deadlines, and difficulties with the preparation of the essential operational and management reporting. Such inefficiencies often lead to real financial loss, for example through interest costs incurred through failure to make timely payments. The key questions relating to evaluating STP focus on understanding the benefits that can be achieved in a specific corporate treasury environment, and quantifying their value in the course of a cost justification exercise for securing the necessary investment budget.

This article analyses, with practical examples, some of the key elements in the evaluation of potential STP benefits. It relates to a wider audience than the treasurers of large and medium-sized enterprises that manage a significant volume of transactions and level of financial risk in-house: it is also applicable to organizations who are evaluating outsourcing service providers, as the quality of the technology being used in such organizations has a direct impact on the quality of service that can be delivered to their clients.

Liberating the treasury team

From a corporate treasurer’s viewpoint, the underlying value of STP can best be understood in the context of their ability to respond positively to the most demanding questions that may be posed by CFOs, auditors and other inquisitors, such as:

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version