by Miguel Silva Gonzalez, Senior Vice President and Treasurer, Delhaize Group

In recent years, particularly since our CFO, Pierre Bouchut, joined the business in 2012, we have taken a proactive approach to increasing free cash flow across the business. We benchmarked our EBITDA, capital expenditure as a percentage of sales and working capital against competitors, and found that Delhaize’s EBITDA margins are amongst the highest in the sector, with capital expenditure as a percentage of sales also broadly in line with our peers. However, this benchmarking process illustrated the need for improvements in working capital performance, with median net working capital of 2.4% of sales over the preceding three fiscal years. This compares with a negative net working capital position amongst most European food retailers.

Identifying opportunities

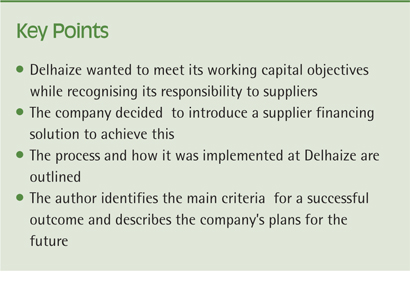

As a retail business, collections are straightforward, as they are done at point of sale. Therefore, our primary focus has been on inventory and payables management. One of the most obvious ways of improving working capital performance is to extend payment terms; however, while this would meet our working capital objectives, we also recognised the negative impact on our suppliers’ working capital. Therefore, we wanted to devise a solution that would allow us to meet our working capital objectives at Delhaize, whilst also recognising our responsibility to suppliers, therefore creating a ‘win win’.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version