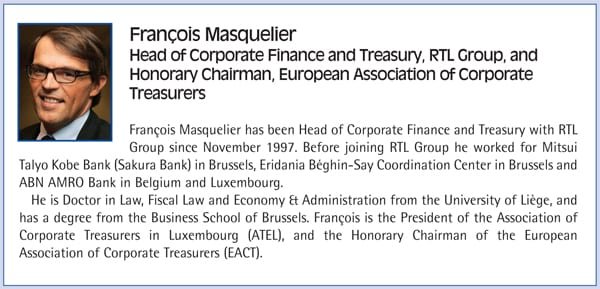

by François Masquelier, Head of Corporate Finance and Treasury, RTL Group, and Honorary Chairman, EACT

Even if corporate treasurers obtain the exemption of OTC derivative reform from the EMIR (European Market Infrastructure Regulation), as we all might reasonably expect, this temporary victory could hide the ineluctable future of the derivative market. Realistically, we can see that derivatives will become more and more expensive over time and that we will have more administration to deal with the various types of financial instruments. The most prudent treasurers would be tempted to say that it would be better to wait for the final outcome of this key reform before shouting ‘victory’. The European institutions and MEPs have accepted the idea of an exemption (despite the fact that some populist tendencies would favour no exception at all). However, the form of the exemption is not yet defined. EACT has heavily lobbied to avoid any exemption based on certain types of products or (even worse), on qualification for hedge accounting. And even if they decide to adopt an exemption based on a defined threshold, there are open questions such as at which level should we fix this threshold and how should we apply it in practice? In case we are above the predetermined threshold (limit), would the whole portfolio be tainted and non-exempted? There are as we can see many open issues even if treasurers succeed in being exempted.

Non full exemption

Unfortunately, the exemption even if finally adopted, will be applied to clearing and to collateral; but it will not cover reporting, which will remain compulsory for all market dealers. For non-standardised and non-clearable contracts, they should be electronically confirmed with auditable monitoring process for all participants and, in this case, no threshold will be applied. Therefore the exemption will remain a partial success for treasurers. No one could contest the aim of having a full picture of each market participant’s full net portfolio situation. The idea is by passing via clearing houses to force market players to secure deals with collaterals and to force a defined reporting to collect all deals netted. For this reporting obligation, all treasurers will have to pass by trade repositories. How does it work? Who are the market players (there are only a few of them e.g., DTTC, ICAP and Clearstream)? Who will pay for it (a priori the corporates will pay for their deals and all banks for theirs)?

If all banks respect BAsel III’s new provisions, they will be negatively impacted when no collateral is required for derivatives.

If the recourse to clearing houses is necessary, which one to use? Does it mean that depending on counterparties, we will have to pass via a CCP and via a trade repository? We can expect a connection between all of them in order to multiply intermediary partners. All these very pertinent questions remain unanswered. In practice, all this nicely planned system will imply a lot of technical issues and will necessitate recourse to IT solutions for automating processes. The timing for the reporting being an issue (no later than trade day plus one) would imply an excellent system to produce reporting in due course on a standard that can be a consolidated format. The CCPs and the trade repositories will have to be interconnected and interfaced to exchange the necessary information in real time. Reporting without being able to give a full and comprehensive position won’t be useful for users.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version