by Rohan Ryan, Head of North America Liquidity Product Solutions Specialists and Stephanie Wolf, Head of Global Financial Institutions and Canada Transaction Services, Bank of America Merrill Lynch

The proposed US liquidity coverage ratio, which is a crucial part of the Basel III global regulatory accord, is broadly seen as more stringent than the Basel Committee’s version and is likely to require investment in systems as well as a reconsideration of business models by some financial institutions.

In October 2013, US financial regulatory bodies published their proposals for the implementation of the Basel III liquidity coverage ratio (LCR) in the US. While the final version of the proposal is yet to be published, the principal features of the plan – and its variations from the Basel Committee’s LCR Framework – are now clear: they have implications for many financial institutions (FIs) in the US.

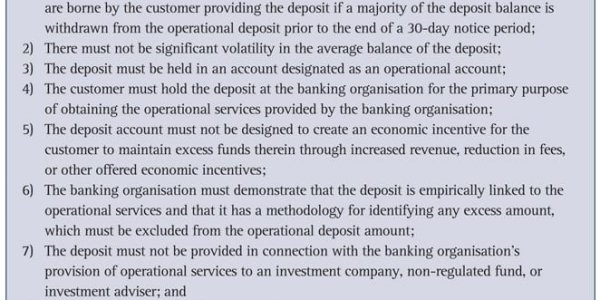

The regulatory proposal defines operational deposits and lists specific criteria that must be met for a deposit to qualify for the more favourable ‘operational’ classification within a bank’s LCR calculation. It also includes specified outflow rates for credit and liquidity facilities and defines High Quality Liquid Assets (HQLA), which must be held against assumed outflows.

One difference between the US proposed LCR and that of the Basel Committee is that the latter calls for a 2015-2019 timeframe with 60% compliance in the first year, while the US approach has a 2015-2017 timeframe with 80% compliance in 2015. The accelerated timetable reflects a “desire to maintain the improved liquidity positions that US institutions have established since the financial crisis,” according to the Federal Reserve [1].

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version