Five leading investment management companies joined TMI to discuss some of the issues that corporate investors are facing today.

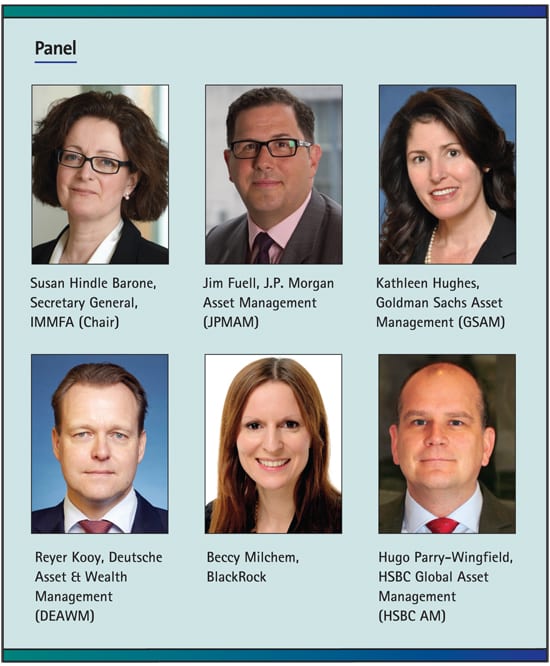

In September 2015, five leading investment management companies joined TMI to discuss some of the issues that corporate investors are facing today, and how they should prepare for changing times ahead with both banking and money market fund (MMF) reforms, and the ongoing challenges of a low or negative interest rate environment. The panel was kindly chaired by Susan Hindle Barone, Secretary General of the Institutional Money Market Funds Association (IMMFA), the trade association which represents the European constant net asset value (CNAV) money market fund industry.

Susan Hindle Barone, IMMFA

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version