by Oliver Klein, Corporate Banking, Sales Specialist, Sales Strategy International Business, Commerzbank AG

Corporate banking products have become highly sophisticated and functionally rich over recent years, and are capable of supporting a wide spectrum of activities across the financial supply chain. The challenge is that these are not necessarily aligned with the specific needs of corporate customers, nor combined into appropriate solutions that are aligned with a customer’s financial supply chain. This article outlines a new and innovative way in which we at Commerzbank’s Cash Management & International Business division are engaging with customers and structuring our solutions to meet the changing needs of businesses operating internationally.

Focusing on the financial supply chain

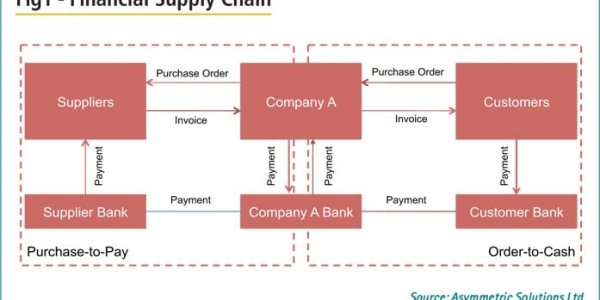

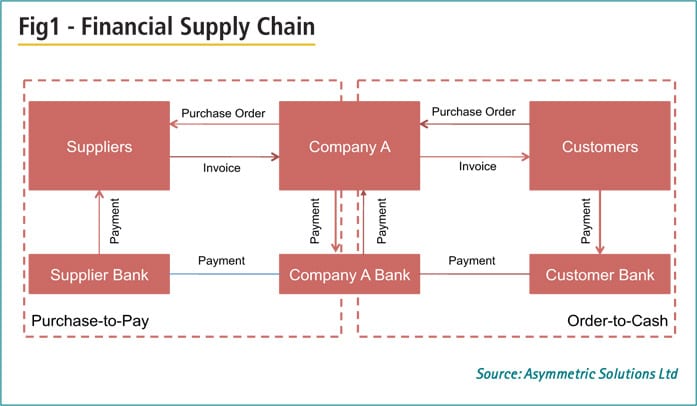

During the 1990s and 2000s, many corporations invested heavily in their physical supply chains with considerable success. Today, integrated ERP platforms to provide visibility and control across the supply chain, efficient inventory management and ‘just-in-time’ manufacturing allows companies in a wide range of industries to meet customer demand for their products and services very precisely. While the physical supply chain involves the sourcing, production and distribution of goods and services, the financial supply chain (figure 1) refers to the flow of cash from customers (order-to-cash) through to suppliers (purchase to pay). It is therefore effectively a mirror of the financial supply chain, and is at least as important to the company’s performance as the physical supply chain. However, many companies have yet to achieve the degree of efficiency in their financial supply that they have with their physical supply chain, despite the equivalent benefits of doing so.

As companies’ supply chains – both physical and therefore financial – become more complex and geographically diverse, the need to enhance automation, visibility and control, and mitigate risk across the supply chain becomes more compelling. Corporate treasurers and CFOs are increasingly recognising this, and are working with procurement, sales, accounts payable and receivable to try and align objectives and streamline processes with a view to reducing working capital levels and enhancing liquidity.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version