by Guy Puttemans, Financial Controller EMEA and Didier Goelens, Finance Manager EU, Nu Skin

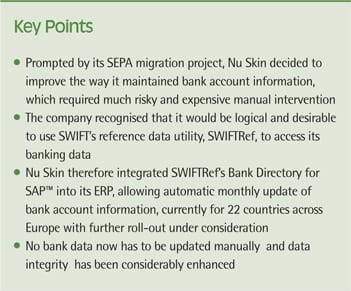

Premium personal care and nutritional supplements corporation Nu Skin was experiencing considerable challenges in maintaining counterparty bank account information in a timely, accurate way, leading to considerable manual intervention, risk and cost. Prompted by its SEPA migration project, Nu Skin has implemented SWIFTRef to automate the maintenance of this data, providing considerable referential integrity and automation.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version