by François Masquelier, Head of Corporate Finance and Treasury, RTL Group, and Honorary Chairman, EACT

In this article we describe the concerns of corporate treasurers with regard to bank account management and try to determine the wish list of processes for its future enhancement. The new eBAM messaging can be one of the solutions, coupled with ad-hoc IT tools to store information and initiate messages to banks. It is also a way to improve even further treasury internal controls. Eventually, a better view of their accounts enables treasurers to better manage bank relationships.

Bank data issue

Treasurers want to better manage and securely store all bank data and official documents (e.g. corporate signatories, proxies and mandates, account opening forms, ISDA schedules, KYC questionnaires, etc…). When treasurers need to show proof or evidence of agreements with original documents, for (internal/external) audit reasons for example, it can be difficult to find them. They have often been signed and exchanged years ago and nobody can find a trace of them. Large corporations work with sometimes more than 20 banks, with paper stashed across the company. They have activities across the world. Who can claim that he is able at any moment to identify the comprehensive list of all his group bank accounts? How can we know which bank accounts are open or closed? The information related to these accounts is spread across the group affiliates, rarely centrally stored and sometimes no one knows precisely who has access to which accounts. The information can be kept somewhere in a filing cabinet or a storage box. When an audit is due, can you immediately and easily identify what your signatories are? Does it take time to communicate changes through the necessary channels when an account signatory leaves the company or changes department? The communication with your banks in terms of power of signatures is generally done on paper and by post. Therefore it takes time to get originals ready and you never know if they will be well received by addressees at the bank. Annual (external) audit confirmations are for all treasurers a classical January nightmare.

Dream solutions

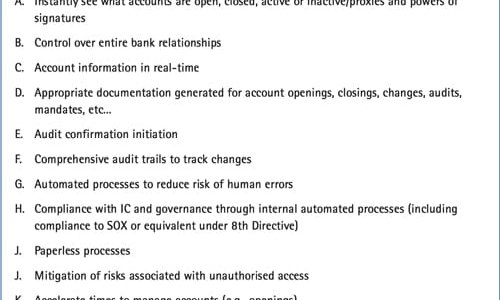

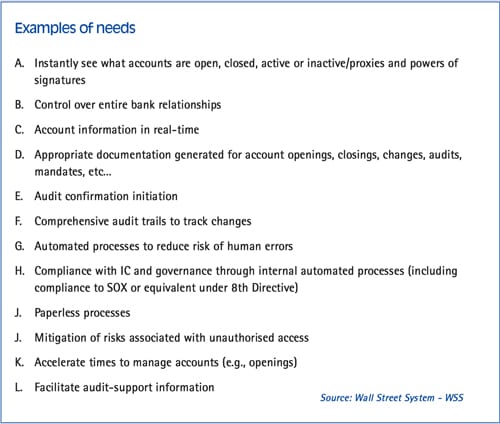

Ideally, treasurers would like to automate workflows, streamline authorisation processes and reduce audit time. They dream of (1) a centralised account management centre, a single centralised and secured repository for all information concerning corporate bank accounts that would enable the treasurer to see, edit and report properly on account access and provides instant document generation. They also dream of (2) a bank management centre providing real-time score cards, including 360 degree view of all the banks with which they work. It should include information on fees, services, ratings, credit profiles and more. In their dreams, treasurers would also like to have an authority management centre, a single central auditable record of who is authorised to initiate, approve and sign any type of financial transaction. What a nice wish list! Is it wishful thinking or technology of the near future which we can foresee and start considering?

There are solutions on the market (a few) which enable treasurers to administer their global banking accounts and the maintenance of them, including: internal signatories, authorisation thresholds and account support documentation.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version