China is now home to the world’s second largest bond market – an interesting potential source of yield and diversification for both global and local investors. With growing opportunities in Chinese fixed income markets, however, comes greater risk. Proper due diligence and rigorous analysis of issuers are critical for understanding the true risk characteristics of onshore credit investments, so that investors may take advantage of the growing market opportunities while minimising risk.

Growing investment opportunities and challenges

China has undergone remarkable economic growth over the past two decades, helped by rapid industrialisation and swiftly developing domestic markets. Underpinning this growth have been China’s fixed income markets, which have seen a massive increase in size and scope.

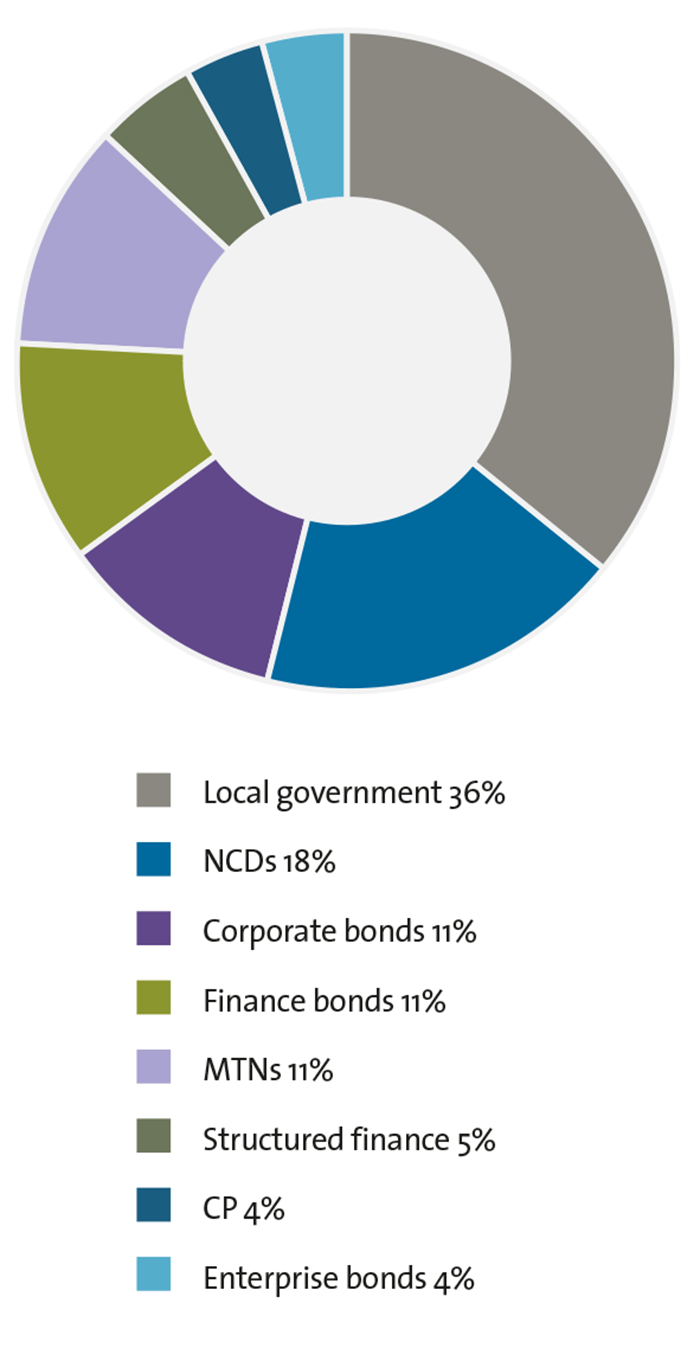

Fig 1: China Credit Market Issuer Mix

Source: J.P. Morgan Asset Management; information as at 30 June 2019.

A period of interest rate liberalisation, part of fundamental financial reform undertaken during the past decade, combined with rapid financial market innovation, has increased the number of investors seeking market-driven yields, the range of Chinese corporate issuers (fig. 1) seeking funding and the variety of instruments available (fig. 2). Together, these forces have precipitated a twelvefold surge in the size of China’s onshore credit market, contributing to the depth, liquidity and vigour of the Chinese bond market today.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version