How Effective is Your FX Hedging Program?

by Scott Bilter, Partner, Atlas Risk Advisory, LLC

Today’s finance professionals are typically well equipped to handle many complex financial problems. They are often experts with Excel and other finance tools, both inside their IT environment and in the cloud, and they are adept at creating various models that are helpful in understanding their business. Despite their extensive expertise, however, many finance professionals have a hard time wrapping their minds around issues related to foreign exchange (FX) risk.

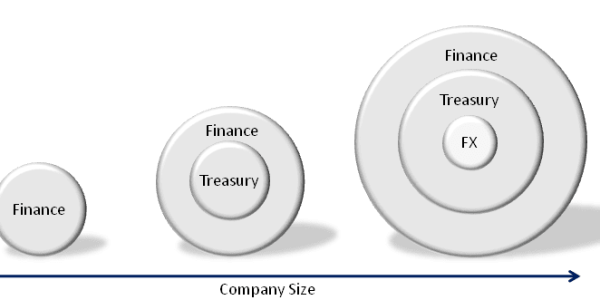

This is largely due to the fact that FX issues are rarely the top concern of finance professionals who do not work in Treasury. Even for those who do work in Treasury, those tasked with managing FX risk are often learning on the job. They need to interact with and rely upon folks outside of Treasury who have other pressing concerns. When it comes to FX, many people are intimidated by “the markets” and fear they might make the wrong decision that will lead to a loss. Even folks who are comfortable making quick decisions elsewhere find themselves “passing the buck” or sticking with an out-of-date strategy when it comes to managing FX risk.

The result is that too many corporate FX hedging programs are reactive and not proactive. The poorly forecasted FX exposures differ significantly from the actual exposures, and there is little understanding of the interaction between income statement and balance sheet risks. The FX risk managers live in fear each month that the volatility in their hedging results will draw unwanted attention from senior management.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version