by Eben Maré, Associate Professor, Department of Mathematics and Applied Mathematics,

Traditionally, market risk is defined as the risk of losses in on- and off-balance sheet exposures as a result of market movements. The market events surrounding the 2008-credit crisis force us to have a deeper understanding of market risk and its effects on our enterprise. The aim of this short article is to present the market risk process and to present its (frequently misunderstood) measurement metrics.

Risk management process

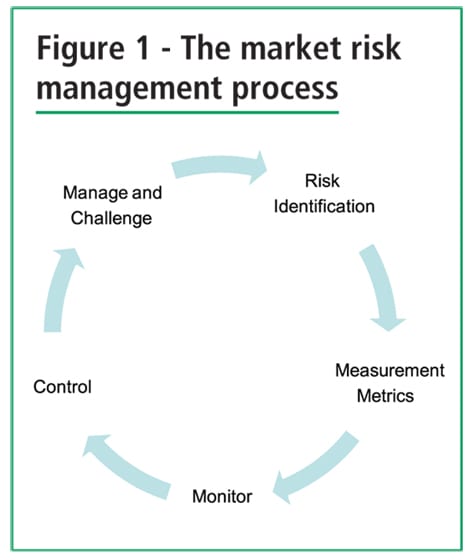

Figure 1 illustrates the market risk management process.

Firstly, risk identification looks at the sources of market risk in our business. This entails understanding our income statement and balance sheet and the source of any changes to these. As part of this process we need to consider carefully how we value any financial instruments directly or indirectly. Direct valuation would pertain to holdings in shares and physical assets, for example, whereas indirect valuation would pertain to embedded derivatives.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version