With responses gathered from 346 senior cash investors around the world, representing a combined cash balance of approximately USD 1 trillion, the latest J.P. Morgan Global Liquidity Investment PeerView survey provides a unique opportunity for corporate treasurers to compare their cash investment practices with those of their global counterparts, while offering worldwide and regional insight into the latest short-term investment trends.

Multiple investment challenges

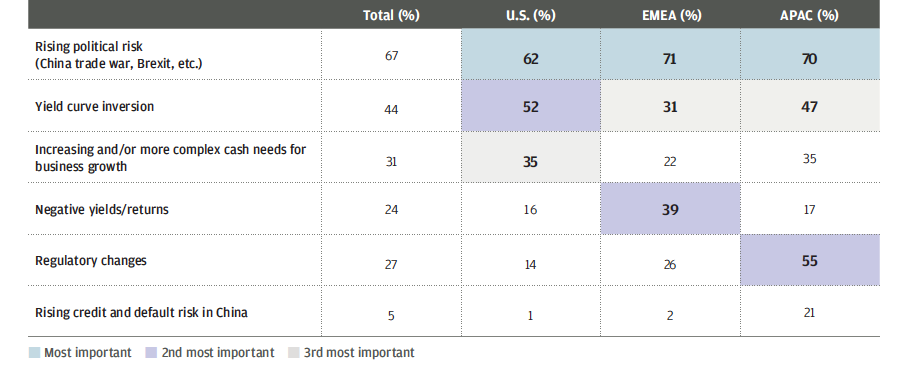

One of the most prominent themes arising from this year’s PeerViewSM survey is the growing spectrum of challenges facing cash investors. Top of the list of investment challenges is rising political risk, with 67% of survey respondents expressing concern about the US-China trade war and Brexit in particular.

Yield curve inversion was ranked the second biggest investment challenge globally, thanks mainly to concerns among US investors. Investors in Europe, the Middle East and Africa (EMEA), on the other hand, are more concerned by negative yields/returns than yield curve inversion, while those in Asia Pacific (APAC) see regulatory changes as the most pressing challenge (see Figure 1). APAC investors are also much more worried about rising credit risk in China than their EMEA and US peers.

Figure 1: Investment challenges

Source: J.P. Morgan Asset Management, as at 30 September 2019.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version