by François Masquelier, Head of Corporate Finance and Treasury, RTL Group, and Honorary Chairman of the European Association of Corporate Treasurers

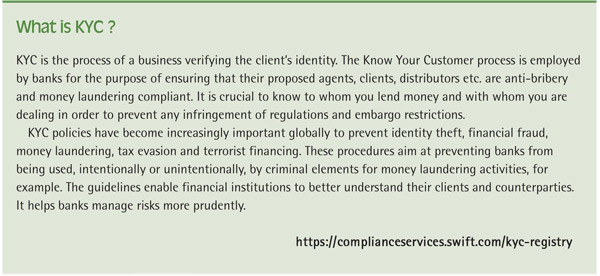

This article tackles the problem of KYC forms – the process of gathering information on bank customers. It is sad that so little has been done to standardise these forms or make them consistent when most of the time they involve the same data being recycled endlessly. Surely solutions could be found that would help set up a central register of this data (banks and customers)? Where are we in terms of KYC? The banks say that this process is one of the most burdensome and costly for them, but nevertheless it is specific and unique to each bank and, even worse, to each country. The time has come to get to grips with this idea and strive to have certain solutions (or at least one) put in place to make life easier for treasurers and to make sure information can be exchanged reliably.

Knowing me, [not] knowing you

The cynics amongst us might be tempted to parody ABBA’s famous song, and change the words to “Knowing me, Not knowing you… ha-ha”.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version