by Danne Buchanan, Executive Vice President, Head of North America Operations, D+H

For multinational corporations selling in multiple currencies, the recent strengthening of the US dollar has turned embedded derivatives from a minor consideration into a material issue. To account for and report on embedded derivatives, most corporations have to date applied a ‘rear view’ perspective, identifying and classifying them at the back end of the receivables process rather than up-front. But by automating receivables and capturing them in a centralised hub, organisations can gain 100% real-time visibility into embedded derivatives – thus dramatically reducing the associated risks, while simultaneously realising wider benefits ranging from a higher rate of straight-through processing (STP) to improved working capital.

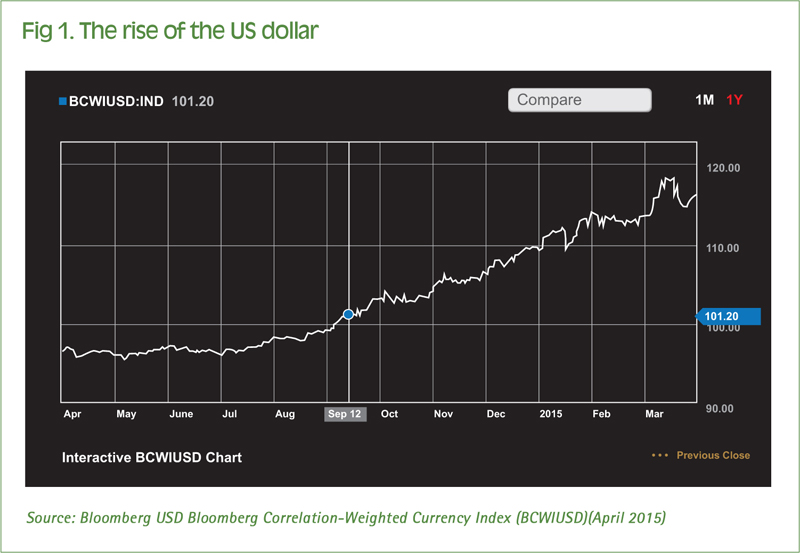

Surge in US dollar value

In March 2015, it was reported that the US dollar was undergoing its “fastest rise in four decades” [1] – a climb accelerated by the US economy’s increasingly robust recovery and a weakening of the euro. For multinational corporations conducting transactions across different currency zones, the strengthening of the dollar’s international value – as illustrated in Figure 1 – represents a significant shift in the business environment.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version